Medicare Commercials & The Truths They’re Not Telling You

If you’re new to Medicare or already have it, chances are you’ve seen commercials with smiling celebrities and actors asking you to call their 800 number. In fact, chances are you’ve probably seen these commercials many many times. You weren’t born yesterday, so after listening to the commercial, you may have been suspicious or had some unanswered questions. And, you would be right do so. This article is a deep dive into these commercials, seeking to give you the truths behind them and answer many questions.

In This Article

These sections appear in order in this article;

- Who Are These Advertisers & What Are They Advertising?

- Breaking Down Advertised Benefits & The Truths Behind Them

- Conclusion & Recommendations For You

Who Are They & Exactly What Are They Advertising?

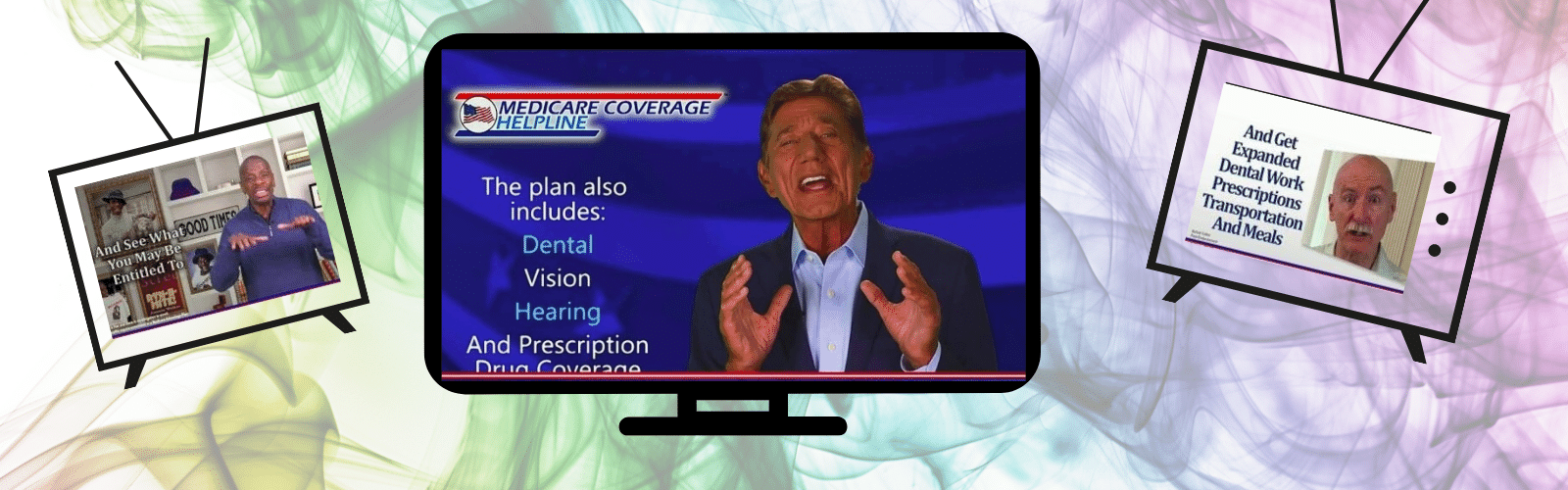

There are a few advertisers that promote their Medicare commercials nationally. The most famous being the “Medicare Helpline,” which was made famous by a celebrity endorsement from Joe Namath. In any case you’re dealing with the same animal; Large, national insurance call centers. And, exactly what are they promoting? They are promoting Medicare Advantage, also known as Part C, which are plans offered by private insurers who have a contract with Medicare. You have the choice of having your coverage through Original Medicare (directly through the government) or through a Medicare Advantage plan available in your county. Here are some other things to be aware of (or beware of) when it comes to these insurance call centers and their commercials;

- They want you to call them – This may seem obvious due to how they constantly say “pick up the phone and call now.” But, the next step can’t happen unless you make the call. This is also why they make it seem like you can everything, making many promises that they won’t be able to deliver on (in most cases).

- They want to sell you something, not help you – Once they have you on the phone, their goal is to sign you up for something. In this situation, often times their goals take priority over yours. I have spoken with many people who complained that they did not actually get what the agent promised and they wound up disappointed after the fact. Again, in most cases, they will say anything to get you to enroll.

- They provide very low quality service – If you are disappointed because you didn’t get what you were promised, don’t bet on getting answers from the agent who signed you up. They know what they did and won’t want to face the music when you call to complain. They will tell you that you need to “call the insurance carrier” or they will tell you that they need to look into it and will call you back. Which, you guessed it, they never will.

Now you know who these people are and the perils of working with them. What about the claims they are making and benefits they are promoting? $0 cost plans, free groceries, and getting $1,700 a year back in your Social Security! Sounds great, right? Yes, there are some good benefits that you can get with Medicare Advantage. And, Medicare Advantage is a good fit for some people, not everyone. As with anything, there is reality and there is hype. Let’s break down the truths behind Medicare Advantage benefits and the claims made in these commercials.

Medicare Commercials Breakdown

These commercials promote many “possible” benefits that someone may be able to get with Medicare Advantage. As I stated earlier, their first goal is to get you to call them. To do this, they use a couple of tricks to entice you; 1. They promote benefits that are not available to most people. 2. They list all “possible” benefits together to make it seem like you can have them all or that you’re missing something. With that said, there are some benefits more readily available with Medicare Advantage than others. Let’s break down each benefit, starting with ones that are rarely available.

Benefits Advertised That Are Rarely Included With Medicare Advantage

- Getting $ Money Back In Your Social Security – These commercials make it seem as if it’s easy to get thousands of dollars per year put back in your Social Security. But, this is only possible in rare circumstances. What they are referring to are rebates or subsidy’s that help pay your monthly Medicare premium. You are not actually getting more money from Social Security, just having your your Medicare cost lowered. You can get these benefits in one of two ways; 1. If you qualify for Medicaid and low income assistance. 2. If there is a plan, that is suitable for you, that provides you with a monthly rebate off your Medicare premium. Again, both of these situations are rare, so this is not readily available.

- Healthy Meals Or Food Delivery – Groceries and Meal Delivery are other items advertised that are rarely available or accessible. Many Medicare Advantage plans do provide meal delivery, however, only after you have a hospital stay. Some plans are also including an allowance for healthy groceries, however, this is usually only available in limited areas for low income individuals.

- Flex Spending Debit Card – A Flexible Spending Card or “Flex Card” is a debit card that gives you a certain amount of money toward health related expenses. This is often for dental, vision, and hearing services. Although this benefit is available with Medicare Advantage plans in certain areas, it is not commonly available.

- Transportation – Free rides to doctors and medical appointments are included with plans in certain areas. Often times this benefit is more available with plans in urban / suburban areas rather than rural. Although this feature is more common than the three above, it’s still not readily available.

Benefits Advertised That Are Often Included With Medicare Advantage

- Dental & Vision Benefits – Dental & Vision coverage has become a stable benefit included with most Medicare Advantage plans. The level of coverage varies from plan to plan, with some having more coverage than others.

- Hearing Aid Coverage – Benefits for hearing exams and coverage for hearing aids are included with most plans these days.

- Prescription Coverage With Home Delivery – Medicare Advantage plans that include prescription coverage will have an option to have your medications delivered. For some people, this can be convenient and lower the cost of medications.

- Over The Counter Medicine & Vitamin Allowance – In addition to prescription medication coverage, most Medicare Advantage plans will include an over the counter medication and vitamin benefit. This allows the member to pick up or receive delivery for a certain amount of these items, either monthly or quarterly.

- Free Fitness & Health Club Access – Pretty much every Medicare Advantage plan includes a fitness benefit that will give the member free gym access. The most common is Silver Sneakers, which manages the network of gyms that accept members.

*The benefits listed above are often included with Medicare Advantage plans for no additional cost to you. In some cases you may have to pay extra for them.

CONCLUSIONS & RECOMMENDATION

Medicare can be confusing and complicated for most people. And, like most things, it’s always changing. The last thing you need is more confusion by getting unreliable guidance and service. With Medicare, in addition to getting the right plan, it is invaluable to have a good agent that you can count on for help. This is not just for when you are starting Medicare, but even more so once you’re enrolled. With this in mind I make the following recommendations so that you may have your best experience;

- Avoid Working With Call Centers – After reading this article you probably understand this. To reiterate, in most cases, these call centers have one goal; To sell you a plan. Their goals often take priority of yours, which can lead to bad results for you. They are also not going to be there for you if you have questions or concerns after you enroll.

- Work an agent who looks out for your interests – There are professional standards that good agents follow in order to help their clients get good results. In this case, their clients needs and interests are first. This type of agent will typically be a full time, long term professional. They are not just “passing through” and trying to sell you something. They value you and your satisfaction and relationship, therefore you’re more likely to have a good experience using them.

- Work with an agent who can offer you multiple programs – We often say, with Medicare, there is no “one size fits all.” Each person has different needs, wants, budgets, and healthcare providers. With this said, working with an agent who can offer you a selection of plans and insurance providers will help you get your best results.

- Share this article with a friend or family member – Your family and friends will need good guidance and to avoid problems just like you. Sharing good information or referring them to the right people can help them tremendously.